Financial reporting dashboards set the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. In the realm of modern business operations, the significance of these dashboards cannot be overstated.

As decision-making processes become more complex, the need for clear, concise data representation is paramount. This article explores how financial reporting dashboards play a crucial role in providing insights through key performance indicators and how they are designed to optimize user experience.

Importance of Financial Reporting Dashboards

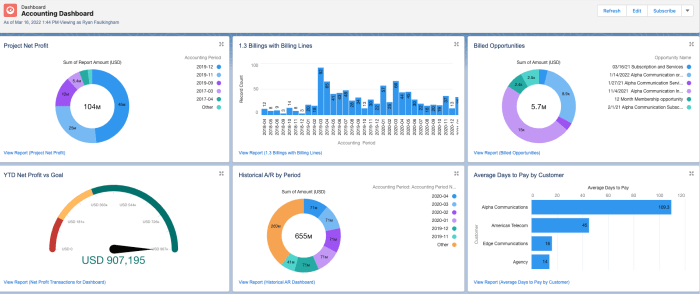

Financial reporting dashboards play a crucial role in the modern business landscape by providing real-time insights into an organization’s financial health and performance. These dashboards consolidate key financial data and metrics into a visual format, allowing stakeholders to quickly analyze and interpret the information.

Enhancing Decision-Making Processes

Financial reporting dashboards help in decision-making processes by enabling users to identify trends, patterns, and anomalies in the data. This allows for informed decision-making based on accurate and up-to-date information, leading to more strategic and effective choices for the organization.

- Revenue Growth: Monitoring revenue growth over time can help identify opportunities for expansion or areas of improvement in sales and marketing strategies.

- Profit Margins: Tracking profit margins can indicate the overall profitability of the business and highlight areas where costs can be optimized.

- Cash Flow: Analyzing cash flow data can help ensure that the organization has enough liquidity to meet its financial obligations and invest in growth opportunities.

- Expense Ratios: Comparing expenses to revenue can reveal inefficiencies in operations and guide cost-cutting initiatives to improve financial performance.

Key Performance Indicators (KPIs)

Financial reporting dashboards commonly include key performance indicators (KPIs) that provide insights into various aspects of the business. These KPIs help stakeholders track progress towards goals, measure performance, and make data-driven decisions.

- Return on Investment (ROI): Calculating the ROI helps evaluate the profitability of investments and assess the effectiveness of resource allocation.

- Debt-to-Equity Ratio: Monitoring the debt-to-equity ratio can indicate the financial leverage of the organization and its ability to manage debt responsibly.

- Operating Cash Flow: Analyzing operating cash flow helps assess the organization’s ability to generate cash from its core business activities.

- Customer Acquisition Cost (CAC): Measuring the CAC helps evaluate the efficiency of marketing and sales efforts in acquiring new customers.

Design and Structure of Financial Reporting Dashboards

When designing a financial reporting dashboard, it is crucial to consider the layout and structure to ensure that the information is presented clearly and effectively. A well-designed dashboard can provide valuable insights into the financial performance of a business, helping stakeholders make informed decisions. Here are some guidelines on designing an effective financial reporting dashboard layout.

Essential Components of Financial Reporting Dashboards

An effective financial reporting dashboard should include the following essential components:

- Key Performance Indicators (KPIs): These are metrics that reflect the performance of the business and help track progress towards goals.

- Financial Charts and Graphs: Visual representations of financial data such as revenue, expenses, and profitability can provide a quick overview of the financial health of the business.

- Drill-Down Functionality: Users should be able to drill down into the data to get more detailed information and understand the factors driving financial performance.

- Filters and Parameters: Allow users to customize the view of the dashboard based on their specific needs and preferences.

- Comparative Analysis: Include tools for comparing financial data over different time periods or against benchmarks to identify trends and anomalies.

Visualization Techniques for Financial Reporting Dashboards

There are various visualization techniques that can be used in financial reporting dashboards, such as:

- Line Charts: Ideal for showing trends over time, such as revenue growth or expense trends.

- Bar Charts: Useful for comparing different categories of financial data, such as revenue by product or expenses by department.

- Pie Charts: Effective for showing the composition of a whole, such as the breakdown of expenses by category.

- Heat Maps: Great for displaying complex financial data sets and highlighting areas of interest or concern.

- Tables: Provide a detailed view of the underlying data and allow users to analyze specific values.

Data Integration and Automation

Integrating data from multiple sources into financial reporting dashboards is crucial for providing a comprehensive view of an organization’s financial health. This allows for better decision-making and strategic planning based on accurate and up-to-date information.

Importance of Data Integration, Financial reporting dashboards

When it comes to financial reporting dashboards, data integration plays a vital role in ensuring that all relevant information is consolidated in one place. This allows for a holistic view of the organization’s financial performance, eliminating the need to manually gather data from various sources.

- Integration of data from different departments or systems helps in identifying trends and patterns that might not be apparent when looking at data in isolation.

- It enables stakeholders to make informed decisions based on a complete picture of the organization’s financial situation.

- By integrating data, organizations can reduce errors and discrepancies that may arise from manual data entry or data silos.

Best Practices for Automating Data Collection

Automating data collection and updating in financial reporting dashboards can save time and reduce the risk of errors associated with manual processes. Here are some best practices to follow:

- Utilize data integration tools that allow for seamless connection between different systems and databases.

- Set up automated data feeds to ensure that information is updated in real-time without the need for manual intervention.

- Regularly monitor data sources and ensure that the automation processes are running smoothly to maintain data accuracy.

Role of Data Accuracy and Real-time Updates

Data accuracy and real-time updates are essential for maintaining the relevance and reliability of financial reporting dashboards. Here’s why:

Accurate data ensures that decisions are based on reliable information, leading to better outcomes for the organization.

Real-time updates allow stakeholders to access the most current data, enabling timely decision-making and adjustments to financial strategies.

Regular maintenance of data accuracy and real-time updates helps in building trust among stakeholders and ensures the credibility of the financial reporting process.

User Customization and Interactivity: Financial Reporting Dashboards

User customization options play a crucial role in financial reporting dashboards as they allow users to tailor the dashboard to their specific needs and preferences. By providing customization features, users can focus on the most relevant data, choose how information is displayed, and personalize the dashboard layout for optimal productivity.

Interactive Elements in Financial Reporting Dashboards

In order to enhance user experience, financial reporting dashboards often incorporate interactive elements that enable users to engage with the data in a more dynamic and intuitive way. Some examples of interactive features include:

- Drill-down functionality: Users can click on specific data points to access more detailed information or underlying data.

- Filtering options: Users can apply filters to isolate specific data sets or time periods for more targeted analysis.

- Interactive charts and graphs: Users can hover over data points to view specific values, trends, or comparisons.

- Customizable widgets: Users can rearrange, resize, or hide different elements on the dashboard based on their preferences.

Data Complexity vs. User-Friendly Design

Balancing data complexity with user-friendly design is essential in financial reporting dashboards. While it is important to provide users with access to comprehensive and detailed data, it is equally crucial to present this information in a clear, concise, and visually appealing manner. Striking the right balance ensures that users can easily interpret the data without feeling overwhelmed by its complexity, ultimately leading to more informed decision-making and improved user satisfaction.

In conclusion, financial reporting dashboards serve as indispensable tools for businesses looking to streamline decision-making processes and gain valuable insights. By integrating data effectively, providing user customization options, and maintaining data accuracy, these dashboards offer a comprehensive solution for modern businesses.

When it comes to big data analytics, Microsoft Azure Synapse Analytics stands out as a powerful tool for processing and analyzing vast amounts of data efficiently. By utilizing this platform, businesses can gain valuable insights to make informed decisions and drive growth.

Understanding various data analysis techniques is crucial for extracting meaningful information from datasets. Whether it’s regression analysis, clustering, or data mining, having a solid grasp of these methods is essential for making sense of complex data sets.

For professionals looking to create compelling visual representations of data, exploring the top data visualization tools is a must. These tools not only help in presenting data in an easy-to-understand format but also aid in identifying trends and patterns that may not be apparent otherwise.